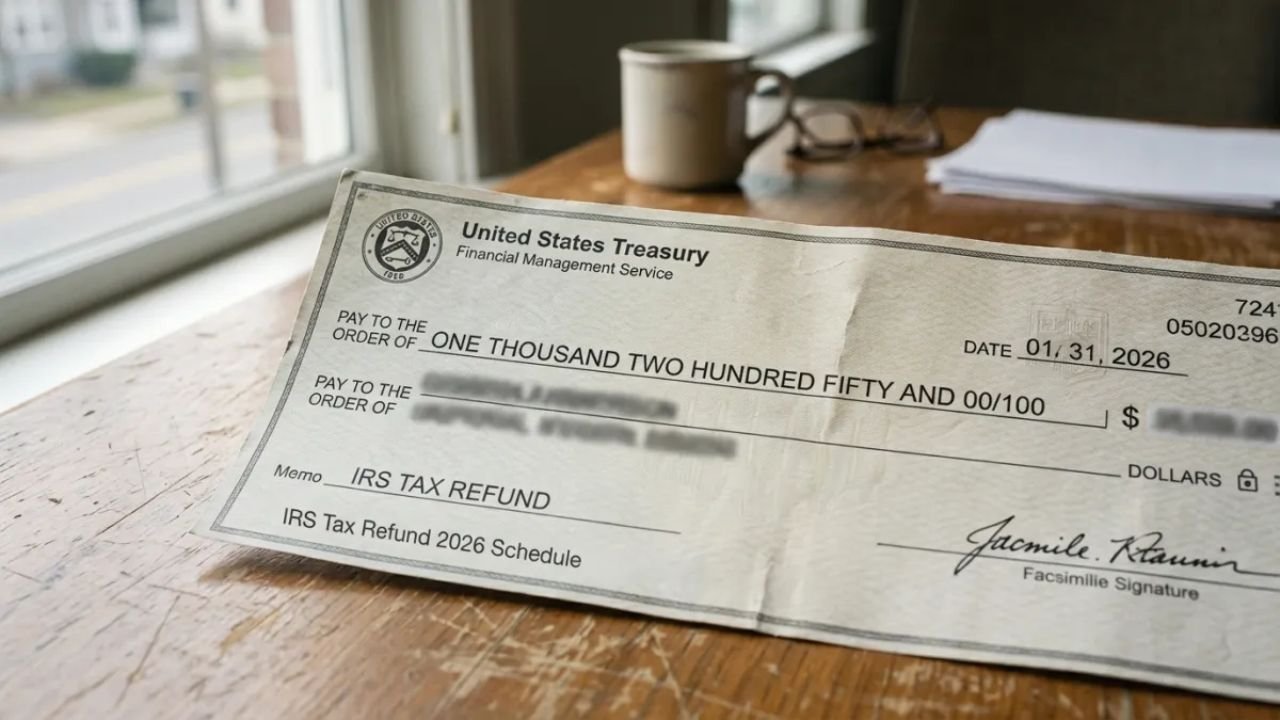

As the 2026 federal tax season approaches, millions of Americans are preparing to file returns for the 2025 tax year. For many households, a tax refund is more than just a routine adjustment—it can be a crucial financial lifeline, helping to cover bills, manage debt, or bolster savings. Understanding how refunds are calculated and when they are typically issued can help taxpayers plan and reduce uncertainty during the busy filing months.

How 2026 Refund Amounts Are Determined

A tax refund occurs when the total federal income tax paid through payroll withholding or estimated payments exceeds your actual tax liability for the year. Several factors influence the final refund amount:

- Annual income – Total taxable earnings determine your base liability.

- Filing status – Single, married filing jointly, or head of household can significantly alter tax brackets.

- Dependents and credits – The Child Tax Credit, Earned Income Tax Credit, and other deductions can boost refunds if eligibility requirements are met.

- Withholding adjustments – Changes to your W-4 during the year may reduce or increase the amount withheld, impacting the refund.

It’s important to note that a larger refund doesn’t mean extra money—it usually reflects overpayment throughout the year. Proper planning with withholding adjustments can help taxpayers optimize cash flow without sacrificing refunds.

When the IRS Will Begin Accepting 2025 Returns

The IRS typically opens the filing season in late January. Although tax software platforms may allow preparers to start inputting information earlier, returns submitted before the official opening are held until the IRS systems go live. Early electronic filers often receive confirmation within 24–48 hours once the filing window is active.

For 2026, historical trends suggest that electronic returns with direct deposit could see refunds issued from late January through mid-February. However, returns claiming refundable credits such as the Earned Income Tax Credit may undergo additional review, potentially delaying refunds until mid- to late February.

Typical Processing Flow

Once accepted, returns enter an automated review system. Most straightforward electronic returns progress quickly through the following stages:

- Return received – The IRS confirms the submission.

- Refund approved – Calculations are verified, and any additional review is completed.

- Refund sent – Funds are deposited or checks are mailed.

Electronic filing is typically faster than paper returns, which may take several weeks to process. Mid-February through March tends to be the busiest period, with higher filing volumes occasionally extending processing times. Returns with mismatched forms, incorrect Social Security numbers, or incomplete information may experience further delays.

Why Direct Deposit Is the Faster Option

Direct deposit remains the quickest and most secure method for receiving refunds. Once approved, funds are transferred electronically, often within about 21 days. Paper checks require printing, mailing, and postal delivery, adding additional time.

For instance, an electronic filer in early February choosing direct deposit may receive funds before the month ends, while a mailed paper return in March could result in payment arriving in April. Opting for direct deposit reduces logistical delays and lowers the risk of lost or misdirected payments.

Common Causes of Refund Delays

Several factors can slow down the refund process:

- Errors on the return – Discrepancies between reported income and employer-submitted W-2 or 1099 forms trigger additional verification.

- Identity protection checks – Anti-fraud measures sometimes require confirmation of personal details before releasing refunds.

- High-volume filing periods – Filing closer to the April deadline can slow processing due to increased workload.

Careful review of your return, especially bank account details and dependent information, can minimize delays and ensure smoother processing.

Who Receives Refunds Earlier

Taxpayers with simple, straightforward returns generally see the fastest refunds. This includes individuals reporting wages from a single employer, claiming the standard deduction, and filing electronically without refundable credits that require extended review.

Conversely, self-employed individuals, those claiming multiple credits, or taxpayers responding to IRS verification requests may experience longer processing times. These delays are routine compliance measures rather than issues with the return itself.

Tracking Refund Status

After filing, taxpayers can track their refund status using the official IRS tracking system. Electronic returns usually appear within a few days, while paper returns may take several weeks before updates are visible. The system updates daily, so repeated checks in a single day are unlikely to show changes.

Maintaining copies of filed returns and confirmation receipts is recommended. If a refund seems delayed beyond typical timelines, contacting the IRS after the advised waiting period may be appropriate. Most refunds, however, are issued automatically without the need for follow-up.

Final Thoughts

While there is no public calendar assigning exact refund dates, historical patterns suggest most electronic refunds occur between late January and April. Timelines depend on individual circumstances, including accuracy, eligibility for credits, and the IRS’s review process. Filing early, choosing electronic submission, and opting for direct deposit remain the most effective strategies for receiving refunds quickly and securely.

Understanding these factors can help taxpayers navigate the 2026 filing season with confidence, ensuring refunds arrive promptly and financial planning remains on track.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or financial advice. Individual refund amounts and timelines may vary. Always consult official IRS resources or a qualified tax professional for personalized guidance.