As February 2026 approaches, anticipation is building around a potential $2,000 federal deposit aimed at providing short-term financial relief to eligible Americans. With rising costs for groceries, rent, utilities, fuel, and healthcare, even a one-time payment could help seniors, retirees, and low-to-middle income households manage essential expenses and reduce financial stress.

While no nationwide rollout has been officially confirmed, discussions reflect the ongoing need for targeted support. If approved, the payment would likely follow patterns seen in previous federal relief programs, using tax filings and benefit records to identify eligible recipients.

Who May Qualify for the $2,000 Federal Deposit

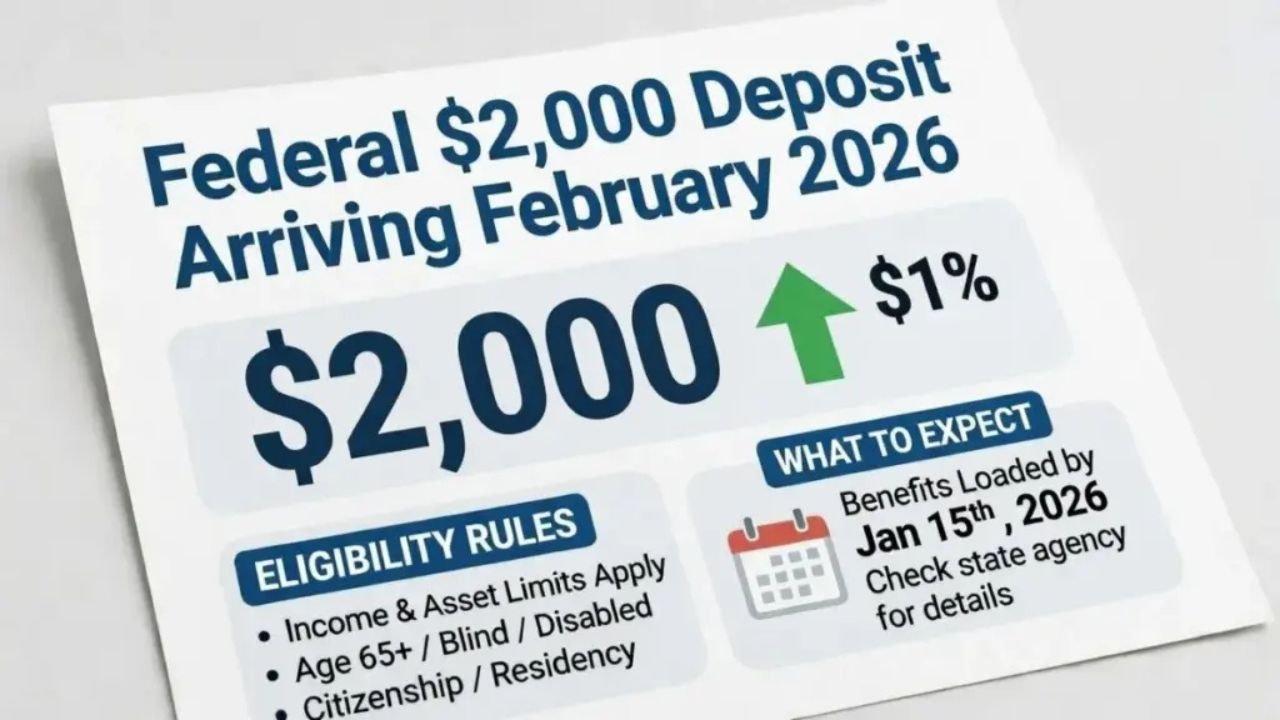

Eligibility is expected to focus on income levels and federal benefit participation. Key groups likely to qualify include:

- Social Security retirement beneficiaries

- Supplemental Security Income (SSI) recipients

- Social Security Disability Insurance (SSDI) recipients

- Veterans receiving federal benefits

- Low-to-middle income taxpayers who filed recent tax returns

- Eligible dependents in qualifying households

Income thresholds are expected to determine whether a recipient receives the full $2,000, a reduced amount, or no payment. Those earning below a defined limit would likely receive the entire payment, while higher earners may see phased reductions. Reviewing your latest tax filing and benefit records can help gauge potential eligibility.

Expected Payment Schedule and Distribution

If authorized, the federal government is expected to distribute payments in phases during February 2026:

- Direct deposits first: Recipients with bank accounts on file will likely receive payments within days of release. This is the fastest and most secure method.

- Paper checks or prepaid debit cards: Individuals without direct deposit information may receive mailed payments later in the month. Delivery times vary depending on postal schedules and location.

Phased distribution helps manage administrative accuracy, reduce processing delays, and limit potential fraud risks.

Steps to Avoid Delays

Households can take proactive measures to ensure timely receipt:

- Update banking information: Verify that accounts on file with the IRS or other federal agencies are current to avoid returned deposits.

- Confirm mailing address: Especially important for paper checks or prepaid cards. Outdated addresses can result in delayed or lost payments.

- File or verify tax returns: Ensuring your latest tax return is submitted helps authorities confirm eligibility and dependent claims.

- Monitor official portals: Use government websites for tracking tools and updates rather than relying on social media or unverified sources.

Spending a few minutes verifying records now can prevent weeks of delay once payments are released.

How Households May Use the Funds

A one-time $2,000 payment can provide immediate financial relief:

- Essential bills: Rent or mortgage, utilities, and groceries.

- Healthcare costs: Prescription medications, insurance premiums, and medical expenses.

- Debt management: Paying down credit cards or other high-interest debts.

- Emergency savings: Setting aside a portion to cover unexpected costs.

Financial planners often recommend splitting payments between urgent needs and savings to maximize the impact and extend benefits beyond a single month.

Impact on Social Security and Federal Benefits

One common concern is whether a one-time $2,000 federal deposit would affect ongoing benefits. Historically, similar relief payments did not reduce Social Security, SSI, or SSDI benefits and were treated as separate assistance, not counted as regular income.

Final guidance will depend on official policy at the time of authorization. Beneficiaries should review notices carefully and, if questions arise, contact the appropriate federal agency directly to confirm eligibility and benefit implications.

Why the Payment Matters

For many households, the $2,000 deposit represents more than a temporary cash boost. It can ease the burden of rising living costs, provide emotional relief, and create breathing room for planning, work, education, and caregiving. While it is not a long-term solution, it offers meaningful short-term stability during a period of financial pressure.

Key Takeaways

- The proposed $2,000 federal deposit aims to support eligible Americans facing higher living costs.

- Eligibility likely depends on income, federal benefits, and updated records.

- Payments are expected in phases: direct deposits first, followed by mailed checks or prepaid cards.

- Maintaining accurate banking and mailing information is critical to avoid delays.

- Funds can be used strategically for bills, debt reduction, and emergency savings to maximize impact.

The February 2026 federal deposit, if approved, represents a targeted, short-term support measure for households navigating financial pressures. Being proactive about eligibility and record verification can help ensure timely receipt and make the most of this temporary assistance.

Disclaimer: This article is informational and based on publicly discussed proposals and past federal payment practices. Official announcements regarding eligibility, payment dates, and distribution will come from authorized U.S. government agencies. Readers should verify details through official sources before making financial decisions.